President Donald J. Trump has announced the imposition of additional tariffs on imports from Canada, Mexico, and China, invoking a national emergency under the International Emergency Economic Powers Act (IEEPA). The decision is framed as a response to escalating concerns over illegal immigration and the growing flow of fentanyl and other illicit drugs entering the US. The tariffs include a 25 per cent duty on all imports from Canada and Mexico, a 10 per cent tariff on Canadian energy resources, and a 10 per cent tariff on imports from China. The White House has emphasised that these measures are essential to hold these nations accountable for failing to curb drug trafficking and illegal immigration.President Trump has positioned these tariffs as a strategic use of the US’s economic leverage to address national security threats, asserting that “access to the American market is a privilege.” He contends that previous administrations failed to effectively employ trade policy to secure US borders and combat drug-related deaths, arguing that the tariffs are necessary to correct this failure.

The announcement has ignited a trade conflict among long-standing economic allies, sparking swift retaliation from the affected countries. This response underscores the rising tensions in global trade relations, potentially destabilizing decades of cooperation.

Economic analysts are warning that the tariffs could fuel inflation, driving up the costs of essential goods such as groceries, gasoline, housing, and automobiles, apparel and footwear—issues central to Trump’s campaign promises of reducing living expenses for Americans. There are growing concerns that these policies, while aimed at securing the US economy and borders, could disrupt global supply chains.

With retaliatory actions expected from key trading partners, this escalation poses a critical challenge to US diplomatic relations and could reshape international trade dynamics. This moment marks a defining test of the administration’s ability to balance economic nationalism with the realities of a globalised economy, potentially reshaping both domestic and global trade strategies.

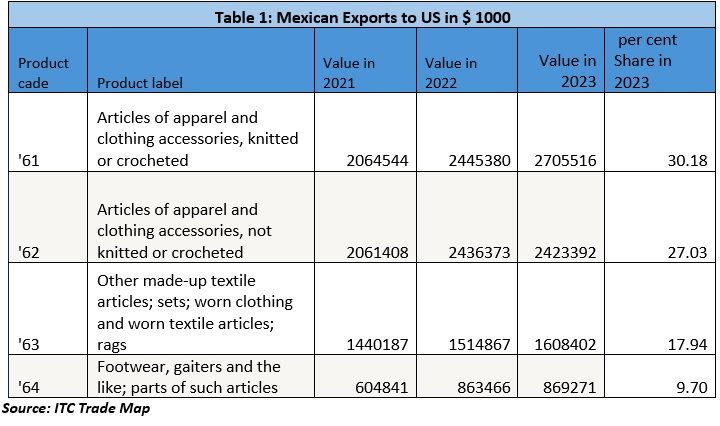

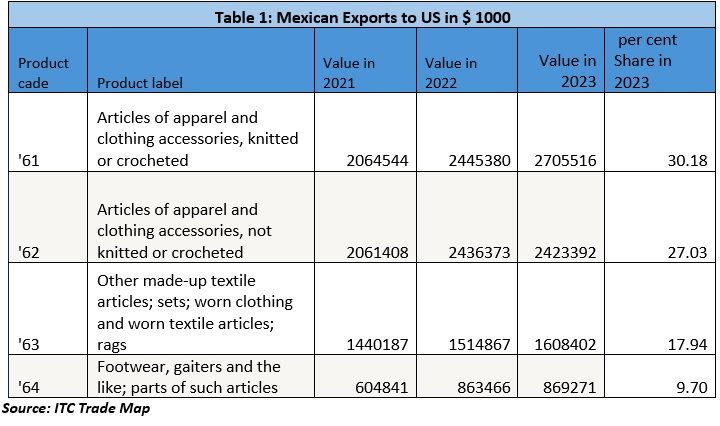

Impact of the 25 per cent Tariff on Mexican Textile and Apparel Exports

A quick analysis of the export data highlights Mexico’s strong dependence on the US market for its textile, apparel, and footwear industries. The newly imposed 25 per cent import tariff on all Mexican products is expected to significantly impact these key export categories, which collectively account for approximately 85 per cent of Mexico’s total textile-related exports to the United States.

Breakdown of Affected Exports

The US has imposed a 25 per cent tariff on textile and apparel imports from Canada and Mexico, citing national security concerns.

This move threatens Mexico's $8.9 billion and Canada's $2.48 billion exports, shifting US orders to Asia, Latin America, and Europe.

Vietnam, Bangladesh, India, and CAFTA-DR nations are poised to benefit as US buyers seek cost-effective alternatives.

1. Apparel (Knitted & Non-Knitted - HS Codes 61 & 62):

- Together, these categories make up over 57 per cent of Mexico’s total textile and apparel exports to the US.

- The US remains a dominant buyer due to Mexico’s proximity, cost-effective production, and USMCA trade benefits.

- The tariff imposition may lead to order shifts to lower-cost Asian countries like Vietnam, Bangladesh, India and Türkiye if brands seek alternatives to offset cost increases. Caribbean Basin initiative countries and EU may also take benefit.

2.Home Textiles & Other Made-up Articles (HS Code 63):

- Representing nearly 18 per cent of total textile exports, this category includes bedding, curtains, and household linens, all of which are widely sourced by US retailers.

- Rising prices due to tariffs could reduce demand from American importers or push them to negotiate lower prices from Mexican suppliers, squeezing profit margins.

3.Footwear (HS Code 64):

- With close to 10 per cent share of textile-related exports, Mexican footwear brands have gained traction in the US due to shorter lead times and competitive pricing.

- A 25 per cent tariff could diminish Mexico’s competitiveness against Asian and European manufacturers, hurting local production and employment.

Potential Consequences

- Higher Consumer Prices in the US: American retailers and brands may pass on the tariff costs to consumers, leading to increased prices for clothing, home textiles, and footwear.

- Supply Chain Disruptions: US companies that rely on just-in-time sourcing from Mexico may face delays or increased operational costs, forcing them to reconsider procurement strategies.

- Shift in Sourcing Strategies: US importers could diversify their supply chains, increasing imports from China, Vietnam, or Bangladesh, despite ongoing trade tensions.

- Economic Impact on Mexico: The tariff could hurt employment in Mexico’s textile and footwear industries, potentially straining Mexico-U.S. diplomatic relations and challenging the trade benefits of USMCA (United States-Mexico-Canada Agreement).

Thus, the 25 per cent tariff imposition on Mexican goods poses a serious threat to the country's dominant textile and apparel exports, particularly as they constitute a significant share of trade with the US. While businesses may explore alternative markets or cost-cutting measures, the immediate effect could be reduced export volumes, disrupted supply chains, and increased production costs, with broader implications for trade relations between the two nations

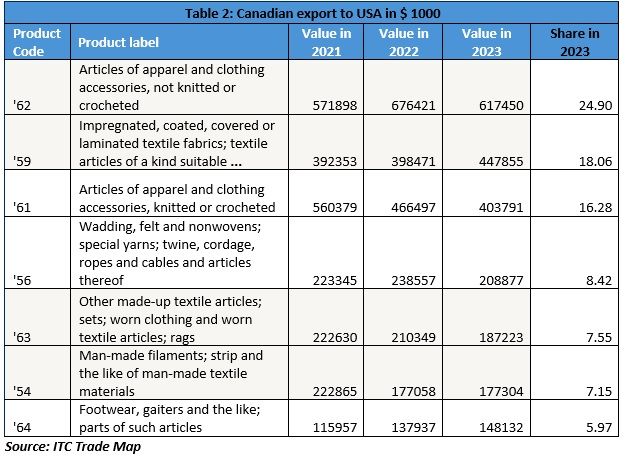

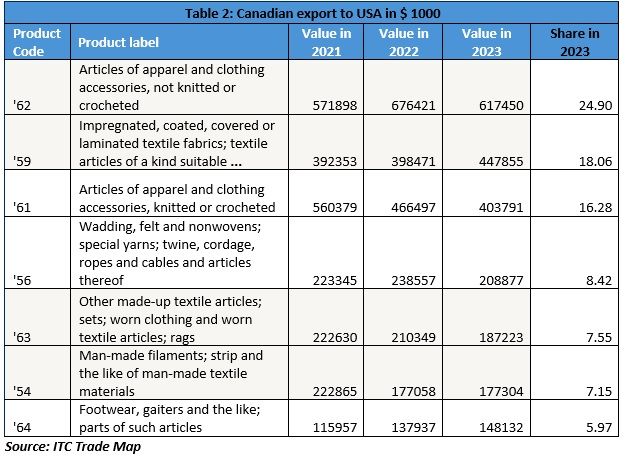

Impact of the 25 per cent Tariff on Canadian Textile and Apparel Exports

As a USMCA member, Canada has a strong trade relationship with the US in textiles and apparel. Clothing dominates exports, with HS Code 62 (non-knitted apparel) at $617.45 million and HS Code 61 (knitted apparel) at $403.79 million, contributing 24.90 per cent of total exports. Technical textiles (HS Code 59) hold an 18.06 per cent share, reflecting growing US demand for advanced materials in healthcare, automotive, and industrial sectors. Other key categories include:

- Wadding, felt, and nonwovens (HS Code 56)

- Made-up textile articles (HS Code 63)

- Man-made fibres and filaments (HS Codes 54 & 55), exceeding $177 million

- Footwear (HS Code 64), showing consistent growth

Traditional textiles like wool, cotton, and silk play a minor role, highlighting a shift towards value-added and sustainable products.

Potential Effects of the 25 per cent Tariff

- Trade Disruptions: Higher costs could reduce Canadian exports as US buyers shift to alternative suppliers.

- Apparel Industry Impact: Price competitiveness will decline, affecting Canadian manufacturers and US retailers.

- Technical Textiles at Risk: The tariff may slow industry growth, impacting US sectors reliant on Canadian inputs.

- Footwear Competition: Canadian exports may lose ground to Asian and European producers.

Thus, the 25 per cent tariff may reshape North American textile trade, prompting US buyers to seek new suppliers and Canadian firms to explore alternative markets. Adaptation through innovation and cost efficiency will be crucial for maintaining competitiveness.

Potential Beneficiaries of US Tariffs on Canadian, Mexican, and Chinese Imports

With 25 per cent tariffs imposed on Canadian and Mexican textile and apparel exports, US buyers will likely diversify sourcing to lower-cost, tariff-free alternatives. The main beneficiaries will be:

1. Asian Exporting Hubs

- Vietnam: A rising textile powerhouse, benefiting from FTA advantages under CPTPP and strong US trade ties.

- Bangladesh: A low-cost apparel hub, particularly in cotton-based garments, which may gain from shifting US orders.

- India: Strong in cotton textiles, man-made fibres, and technical textiles, India can leverage trade diversification efforts.

- China: Despite existing US tariffs, China remains a dominant textile supplier with vast production capacity and cost efficiency.

2. Central and South America

- Honduras, El Salvador, Guatemala, and Nicaragua: Key U.S. apparel nearshoring partners under CAFTA-DR, offering duty-free advantages.

- Brazil and Colombia: Strong in technical textiles, synthetic fibres, and apparel manufacturing, appealing to US buyers.

3. Other USMCA-Alternative Suppliers

- Türkiye: Competitive in synthetic textiles and high-quality apparel, with a growing presence in the U.S. market.

- European Union (Italy, Portugal, Spain): Niche supplier of high-end and technical textiles, benefiting from US interest in sustainable products.

Conclusion

The US tariff hike on Canadian and Mexican textiles will push buyers to diversify sourcing, benefiting Asian, Latin American, and select European suppliers. Countries with low-cost production, FTAs, and technical textile capabilities will gain the most.

Fibre2Fashion News Desk (WE - PN)